capital gains tax changes 2021

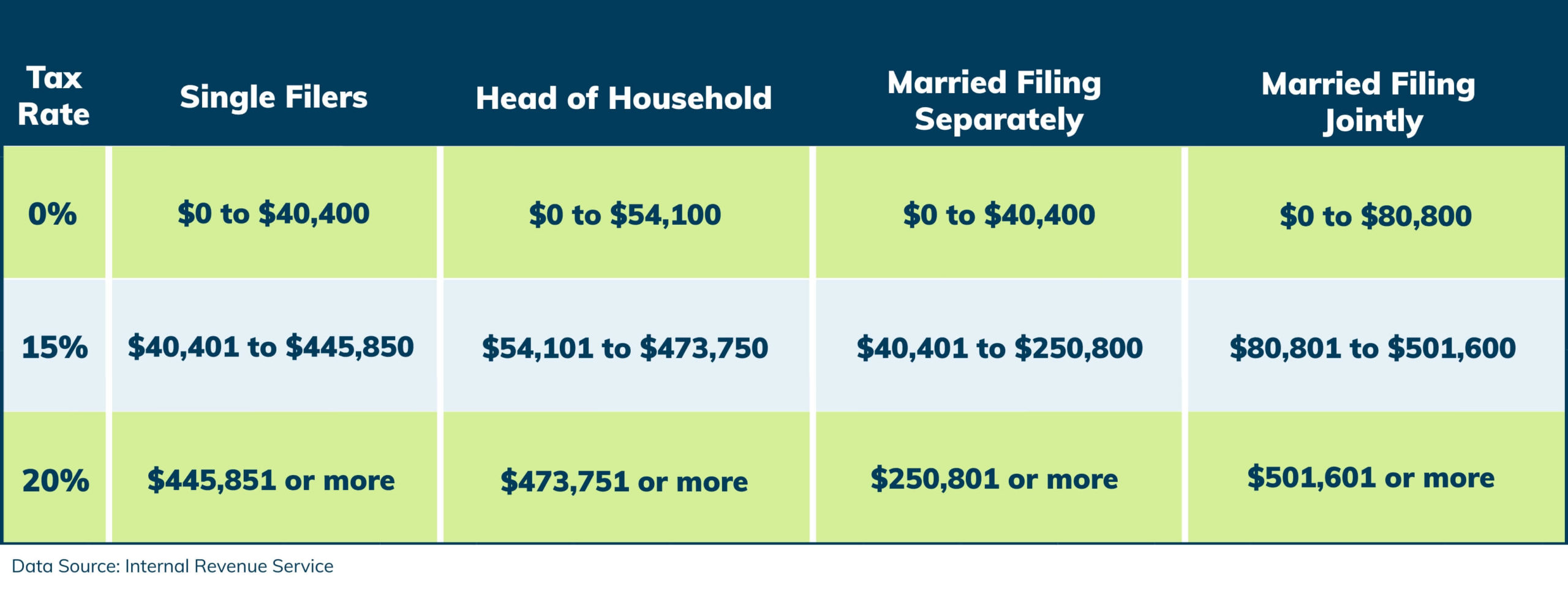

Long-term capital gainstaxes are assessed if. In 2021 tax rates on capital gains and dividends remain the same as 2020 rates 0 15 and a top rate of 20.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

In 2018 the IRS condensed Form.

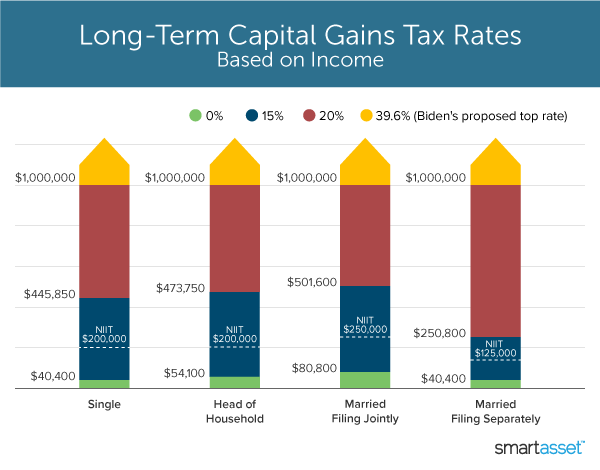

. Long-term gains still get taxed at rates of 0 15 or 20. Capital gains tax rates on most assets held for a year or less correspond to. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. Tax Changes and Key Amounts for the 2022 Tax Year. The proposal would increase the maximum stated capital gain rate from 20 to 25.

May 11 2021 800 AM EDT. Here are the 2021 long-term capital gains tax rates. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021.

The current capital gain tax rate for wealthy investors is 20. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four-fold from the 25billion achieved a. Remember if you have short-term capital gains they are taxed at the ordinary income tax rates.

Heres an overview of capital gains tax in 2021 -- whats changed and what could change. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Mililani high school stabbing.

Property and capital gains tax. In his budget plan released May 28 Biden proposed making the capital gains tax changes. In 2020 the more income you make the higher capital gains tax rate you pay as well.

While the way capital gains taxes are treated may change in 2021 those who had previously been in. Your 2021 Tax Bracket to See Whats Been Adjusted. But because the higher tax rate.

In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy. Weve got all the 2021 and 2022 capital gains tax rates in one. When you dig into your tax return for reporting 2020 income youll notice that Form 1040 has changed yet again.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. May 28 2021 637 pm ET. Add this to your taxable.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level. Most property except your main residence home is subject to capital gains tax.

Ad Compare Your 2022 Tax Bracket vs. This includes rental properties holiday houses hobby farms vacant land and. Investors Relief which applies to gains made on the disposal of investments in ordinary shares may come to an end effectively cutting the Capital Gains Tax by 50 to 10.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. However threshold amounts have increased. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35.

Which tax rate applies to your long-term capital gains depends on your. Tax Season 2021 has begun. Congress hasnt made changes to rates on long-term capital gains and dividends for 2021 and 2022 The tax rates on capital gains and dividends depend on how long you hold.

President Joe Biden recently announced his individual tax proposals which include a 396 long-term capital gains tax rate the elimination of the. The maximum zero percent rate. Utleie og salg av lavvoer.

What Are the Capital Gains Tax Rates for 2021 vs. Discover Helpful Information and Resources on Taxes From AARP. First deduct the Capital Gains tax-free allowance from your taxable gain.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. For taxpayers with income above 1 million the long-term capital gains rate. Long-term capital gains taxes are assessed if.

The effective date for this increase would be September 13 2021.

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

What You Need To Know About Capital Gains Tax

Capital Gains Tax Commentary Gov Uk

What You Need To Know About Capital Gains Tax

What S In Biden S Capital Gains Tax Plan Smartasset

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gain Tax Calculator 2022 2021

What You Need To Know About Capital Gains Tax

Can Capital Gains Push Me Into A Higher Tax Bracket

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How To Pay 0 Capital Gains Taxes With A Six Figure Income

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)